Market Research Firm Report

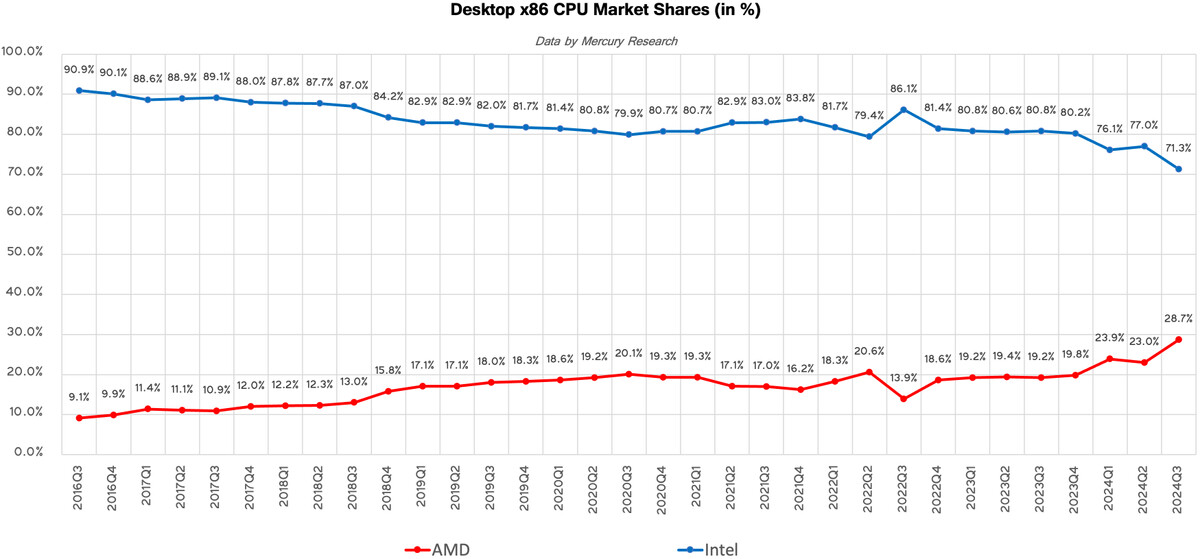

Based on data from Mercury Research, the desktop CPU market has undergone a significant transformation, with AMD capturing a notable 28.7% market share in Q3 of 2024. This marks a substantial increase since the introduction of the original Zen architecture in 2017. The 5.7 percentage point rise from the previous quarter demonstrates AMD's ongoing innovation in competition with industry leader Intel. Their year-over-year growth of nearly ten percentage points, driven by the success of the Ryzen 7000 and 9000 series processors, stands in contrast to Intel's challenges with their Raptor Lake processors, which faced stability issues. AMD's revenue share also increased by 8.5 percentage points, indicating strong performance in premium processor segments. Intel, on the other hand, saw a decrease in desktop market share to 71.3%, attributing this shift to inventory adjustments rather than competitive pressure.

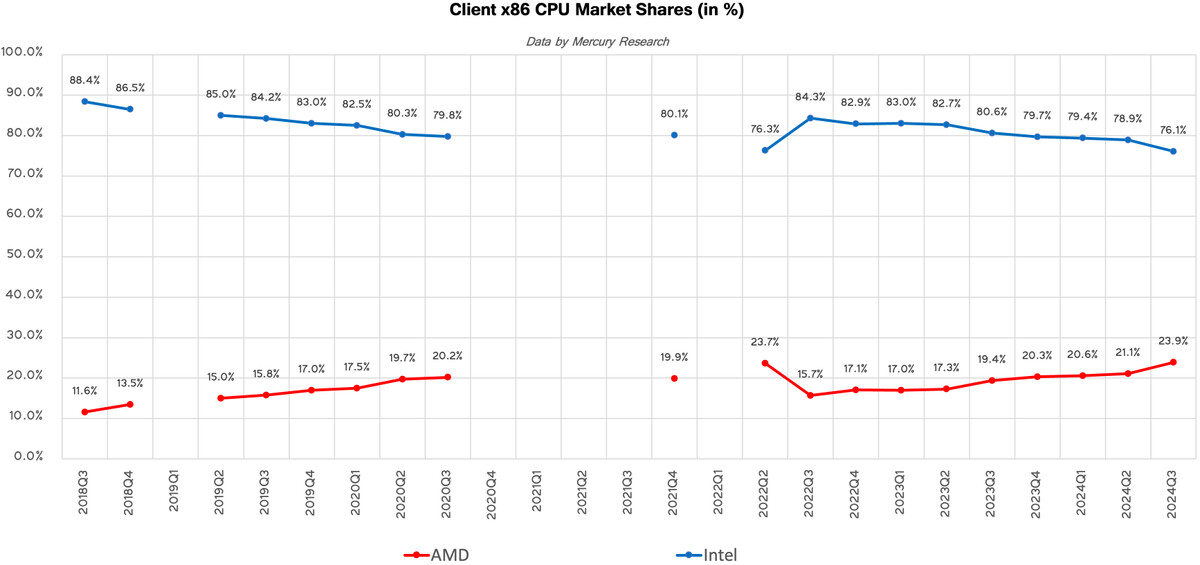

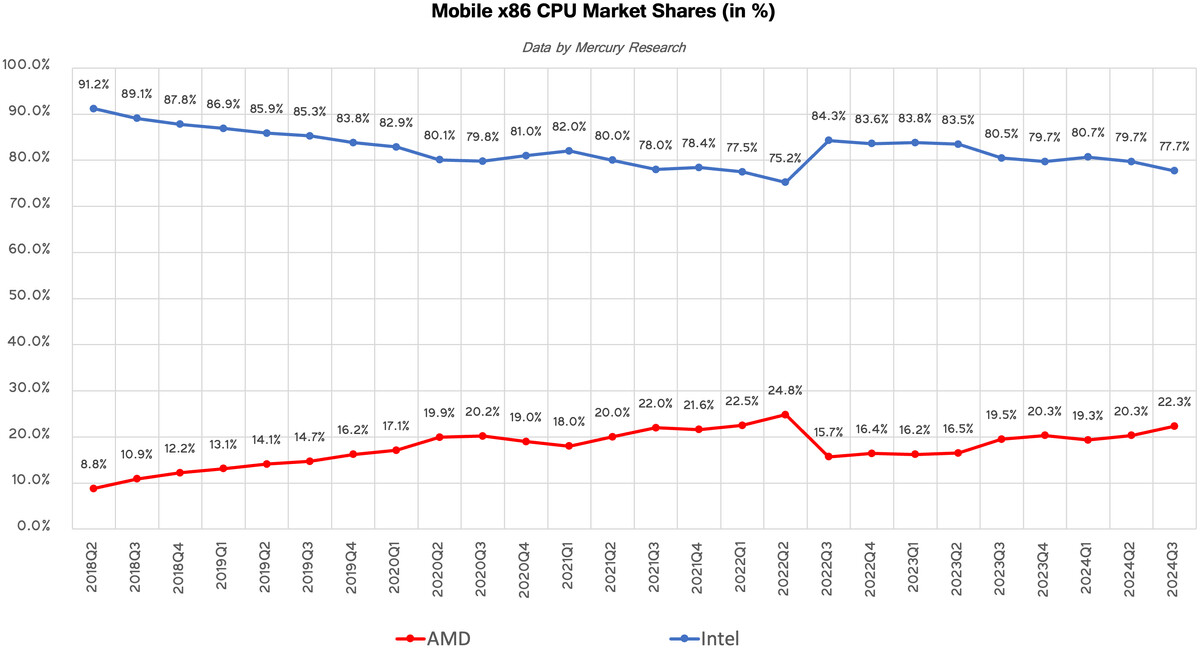

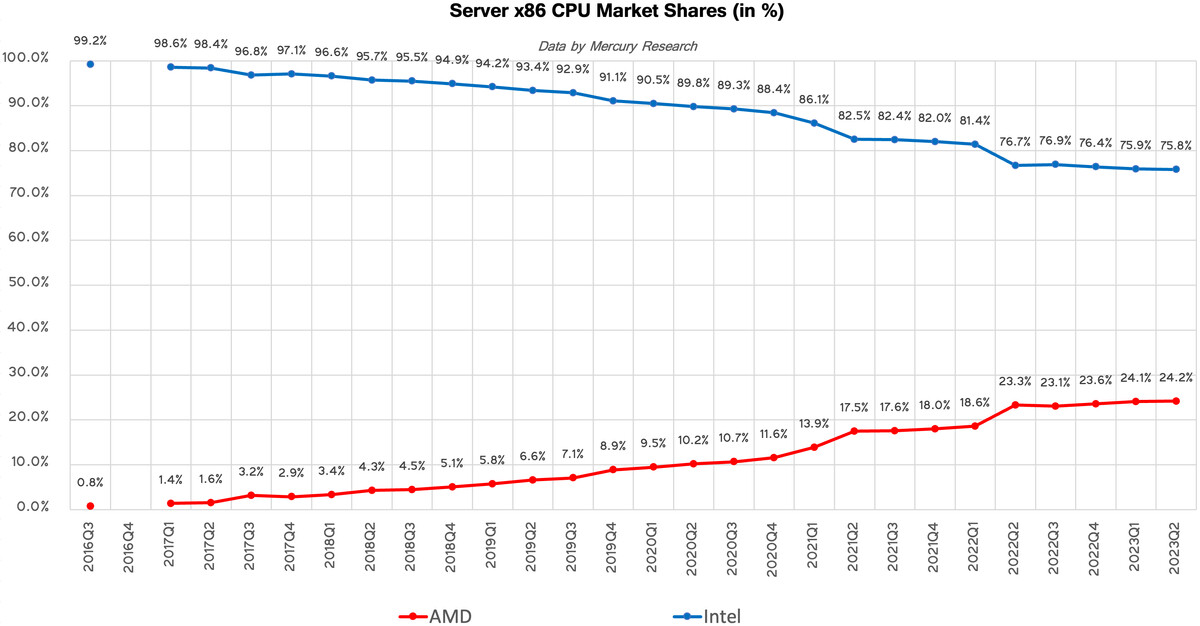

AMD's success extends beyond desktops, with the company claiming 22.3% of the laptop processor market and 24.2% of the server segment. A significant milestone was achieved as AMD's data center division generated $3.549 billion in quarterly revenue, a record for a company that had minimal presence in the data center space just ten years ago. This growth is fueled by strong sales of EPYC processors to hyperscalers and cloud providers, as well as the Instinct MI300X for AI applications, driving significant data center deployments for AMD. Despite these changes, Intel maintains its dominant position in client computing, holding 76.1% of the overall PC market due to its strong corporate relationships and extensive manufacturing capabilities. OEM partners such as Dell, HP, Lenovo, and others continue to rely on Intel for their CPU needs, supplying institutions like schools, universities, and government agencies.

Charts

Below are charts illustrating AMD's progress in the mobile and server markets: