TrendForce Report on HBM Market

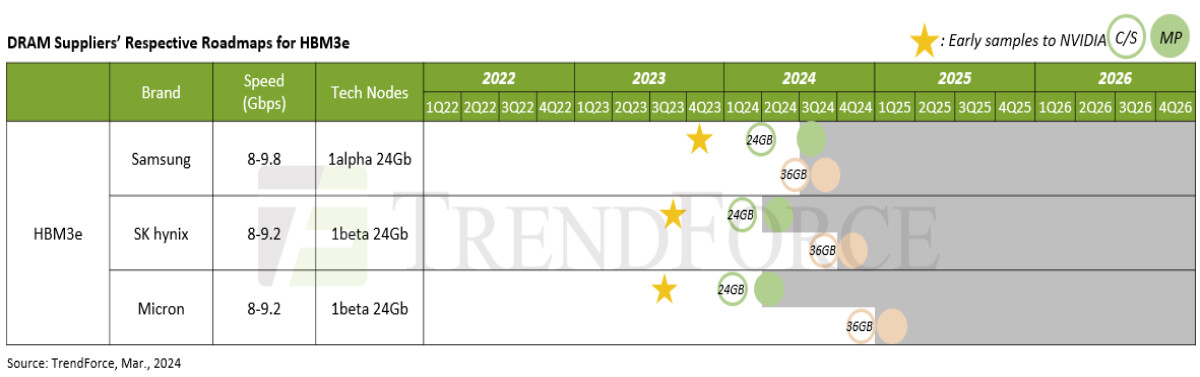

TrendForce has provided an overview of the current state of the HBM market, with a focus on HBM3 as of early 2024. NVIDIA's upcoming B100 and H200 models will feature advanced HBM3e, representing a significant advancement in memory technology. However, challenges arise due to supply bottlenecks caused by CoWoS packaging limitations and the lengthy production cycle of HBM, resulting in a timeline exceeding two quarters from wafer initiation to final product.

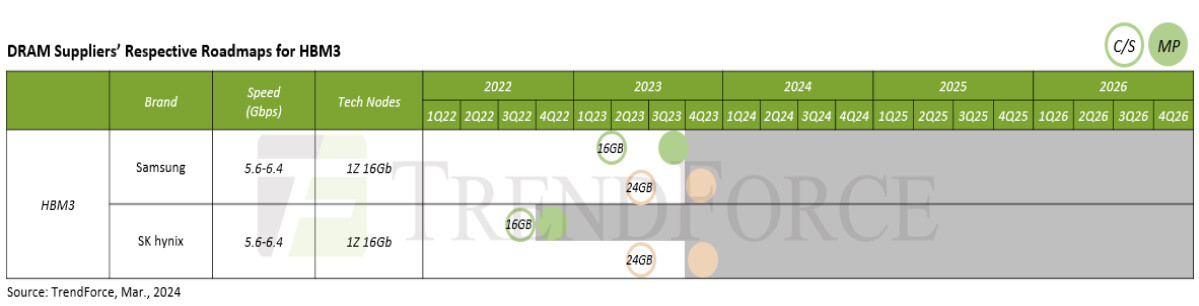

The supply of HBM3 for NVIDIA's H100 solution is mainly sourced from SK hynix, leading to a shortage in meeting the growing demands of the AI market. Samsung's introduction of its 1Znm HBM3 products into NVIDIA's supply chain in late 2023, while initially small, marks a breakthrough in this sector. HBM3e is expected to be gradually released quarterly in the second half of the year, with Samsung and Micron joining the supply chain.

Samsung's progress continued as its HBM3 offerings received certification for the AMD MI300 series by the first quarter of 2024, solidifying its position as a key supplier to AMD. This achievement sets the stage for an expansion of Samsung's HBM3 production distribution starting in the first quarter of 2024. Notably, Micron has yet to enter the HBM supply market, leaving SK hynix and Samsung as the primary players. Samsung, in particular, is poised to gain market share rapidly as AMD's MI300 series distribution increases in the following quarters.

Beginning in 2024, the focus of the market will shift from HBM3 to HBM3e, with expectations of a gradual increase in production throughout the second half of the year, positioning HBM3e as the new standard in the HBM market. TrendForce indicates that SK hynix led the way with HBM3e validation in the first quarter, followed closely by Micron, which plans to start distributing HBM3e products towards the end of the first quarter, aligning with NVIDIA's H200 deployment by the end of the second quarter.

Samsung, slightly behind in sample submissions, is projected to complete its HBM3e validation by the end of the first quarter, with shipments expected in the second quarter. With Samsung's advancements in HBM3 and the impending completion of HBM3e validation, the company is set to narrow the market share gap with SK hynix by the end of the year, reshaping the competitive landscape in the HBM market.